How to do the math that will lead you to the smarter decision.

Getting a job done efficiently requires the right equipment, and that equipment represents a big chunk of a project’s budget, and the company’s budget. Doing the math on whether it’s smarter to buy or rent a particular piece of equipment is an important part of a fleet manager’s job — but the math isn’t always easy.

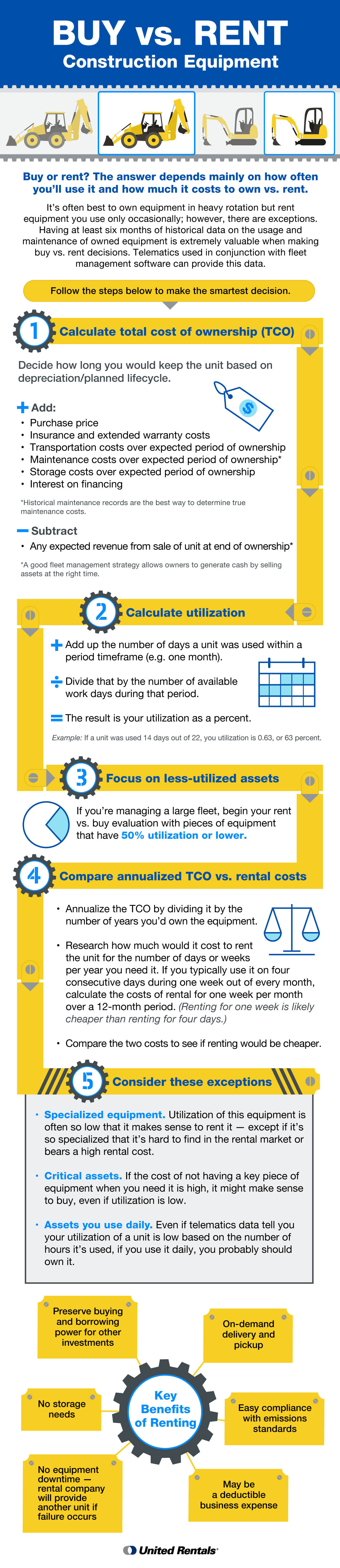

Ultimately it comes down to comparing the total cost of ownership (TCO) against the cost of renting, and taking into account how often you’re going to use the equipment.

“Our two big variables are ownership cost and utilization,” said Bret Kasubke, director of Customer Equipment Solutions at United Rentals. “It’s a matter of calculating ownership costs and bouncing that against the time you’re actually using the unit. Then compare that to the cost associated with renting the unit.”

TCO includes many costs beyond the purchase price, such as transportation, maintenance and repair (including parts and labor), storage, and fuel and oil, minus any residual income from the sale of the equipment at the end of its lifecycle.

If you manage a large fleet, making a buy vs. rent analysis for every piece of equipment probably isn’t feasible, so start with the equipment you use less often, since those units are more likely to be good rental candidates.

To determine your daily utilization for a particular asset, total the number of days it was used over the course of a month. Include partial days (if a mini excavator was used on six half days, consider that three full days). Divide the sum by the number of work days in the month. If the result is less than 0.5 (50 percent), the asset is probably worth analyzing further as a candidate for renting, since it spends much of the time idle and is meanwhile depreciating in value.

To make the buy vs. rent analysis, use your historical maintenance records to compare the TCO for a particular time period — preferably at least six months — against the cost of renting a similar piece of equipment for the time the unit was used. As a general rule, the lower cost wins.

There are some exceptions. Equipment that’s so specialized that it’s hard to rent or costs a lot to rent should probably be owned, as should equipment with a high cost of failure — in other words, not having it when you need it would cost you dearly in downtime. “If you have an asset that's sitting on standby in order to be able to react quickly and the cost of failure associated with that unit is really high, then that may be an outlier — it makes more sense to buy, regardless of any other factors,” said Kasubke.

Renting equipment makes sense when you can get the job done faster by renting exactly the right machine with the right technology, and when you want to avoid a capital expenditure. Newer machines may also help you stay compliant with emissions regulations.

Making buy vs. rent decisions for an entire fleet is a major undertaking. United Rentals can help. To request a no-cost fleet evaluation from United Rentals’ fleet management experts, contact a representative of the United Rentals Customer Equipment Solutions group.

When it manages a customer’s fleet operations, United Rentals can pinpoint their historic and current utilization of units via Total Control, a proprietary cloud-based fleet management system. Total Control leverages telematics on both owned and rented equipment to create an accurate picture of utilization for each piece of equipment. After several months of monitoring a customer’s utilization and maintenance, United Rentals can make a quantitative buy vs. rent recommendation.